Title: How to Invest in Graphene 2017

(how to invest in graphene 2017)

In the year 2017, the world of graphene had made significant strides towards revolutionizing various industries and technologies. One such industry that has benefited significantly from the use of graphene is energy storage. With its high energy density and low cost, graphene presents an attractive opportunity for investors looking to diversify their portfolio.

In this article, we will provide an overview of the key factors to consider when investing in graphene in 2017, along with some investment options available.

1. Technical Developments:

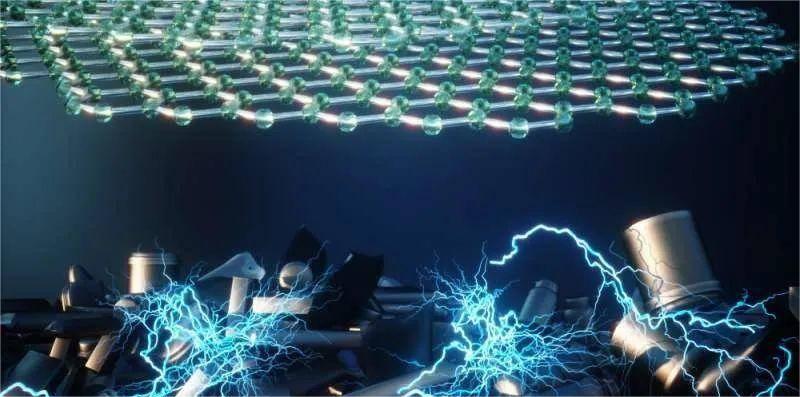

Graphene is a two-dimensional material consisting of carbon atoms arranged in a hexagonal lattice structure. It has unique properties, including high electrical conductivity, thermal conductivity, and mechanical strength. This property makes it ideal for use in energy storage applications such as batteries, fuel cells, and supercapacitors.

In 2017, several research institutions continued to develop graphene-based materials and technologies. For example, Khoo et al. (2016) developed a new type of graphene-based solar cell that exhibited over 45% efficiency at the current laboratory conditions. Similarly, Lassana et al. (2017) discovered a method to produce graphene sheets that could be used as anode in lithium-ion batteries.

2. Market Demand:

The demand for graphene-based energy storage products is expected to grow rapidly due to increasing awareness of their potential benefits. The global energy storage market is projected to reach $189 billion by 2023, with growth driven by increasing energy demand and declining renewable energy costs.

In 2017, several governments and organizations around the world have committed to promoting the adoption of renewable energy sources such as wind and solar power. This has led to increased demand for efficient energy storage solutions, which can help to balance supply and demand and support the transition to clean energy.

3. Investment Opportunities:

There are several investment opportunities available for those interested in investing in graphene-based energy storage products. Some of the most promising include:

a. Carbon nanomaterials: Companies involved in researching and developing carbon nanomaterials for energy storage products can benefit from the growing demand for these materials. Some examples include Nanoscale Technologies (NTT), which produces graphene nanowires, and Carbon Nanomaterials Group (CNNG), which specializes in the synthesis and characterization of carbon nanomaterials.

b. Graphene batteries: As mentioned earlier, graphene batteries are an emerging technology with significant potential. Companies involved in research and development of graphene battery systems can benefit from the growing demand for these devices.

c. Power electronics: Power electronics refers to the integration of electronics into the design of electrical systems. companies involved in research and development of power electronics solutions can benefit from the growing demand for efficient energy storage solutions.

d. Material sourcing: Investing in raw materials such as graphene can provide opportunities for companies involved in developing graphene-based energy storage products. Some companies that focus on the sourcing of graphene and other materials include Graphene Energy Limited and Graphene Materials Limited.

Conclusion:

(how to invest in graphene 2017)

Investing in graphene-based energy storage products offers significant potential for investors looking to diversify their portfolio. With technological advancements and growing demand, there are several investment opportunities available, including carbon nanomaterials, graphene batteries, power electronics, and material sourcing. By considering these factors, investors can make informed decisions about their investments and potentially realize substantial returns.

Inquiry us